Investment Funds (including sub-funds) registered in Malta

of which

Notified AIFs: 18

Funds Administrators:

26

Fund Managers:

80+

Cell Companies:

6

Incorporated Cells:

21

Net Asset Value of Malta Domiciled Funds:

€10.8 billion as at end 2017

of which

New Authorisations 2017

Asset Allocation

Diversified funds:

€4.3 bn

Equity funds:

€2.85

Bond funds:

€1.79

Mixed funds:

€0.84

Fund Categories

Malta established its reputation as a hedge fund domicile when it joined the EU on the 1st of May 2004. This placed Malta on an equal playing field as other EU country. At the time only four hedge funds were domiciled in Malta; now over 400 investment services are issued. At the end of 2017 there were 670 licensed funds in Malta; this shows a growth of 6.2% since 2016. Currently Malta hosts over 580 investment funds which add up to an average of €10 billion. The introduction of passporting rights, on the 1st of January 2008, introduced the registration of investment services and UCITS schemes that can be passported to any EU country. The adoption of the euro also removed currency exchange costs and put an end to unprofitable trades.

The MASA which was partly founded by HSBC Global Asset Management is a full member of the European Fund and Asset Management Association (EFAMA). Since 2003 and the end of 2013 European investment fund assets have more than doubled thanks to average annual growth of 7.3%. Over the decade European investment funds have attracted net sales of EUR 2,420 billion. In Europe total assets under management have increased 9% in 2013 and 15% in 2014, reaching an estimate of €19 trillion by the end of 2014. It is estimated that 410,000 employees have been indirectly recruited, and engage in the asset management industry, resulting in an estimated 500,000 of total employment.

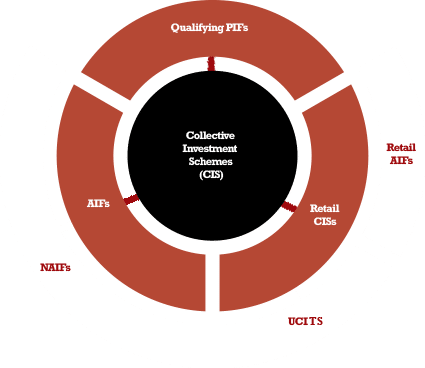

Analysis of Collective Investment Schemes licensed by the Malta Financial Services Authority